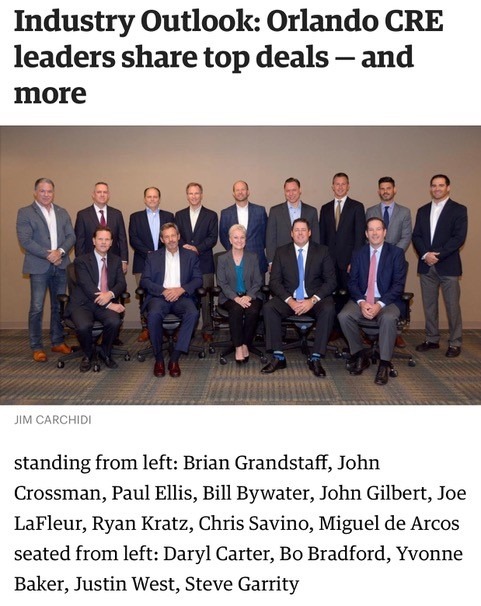

Industry Outlook: Orlando CRE leaders share top deals — and more.

Orlando’s commercial real estate industry is booming — and the area has benefited from some pretty spectacular deals in the last year.

That’s according to local leaders at Orlando Business Journal’s Commercial Real Estate Industry Outlook, who gathered to discuss the latest in Central Florida.

A total of 16 managing directors, principals and other top executives from some of the region’s largest commercial real estate brokerages gathered on Oct. 2 at Lynx’s downtown Orlando headquarters for the roundtable event. And several topics were addressed, including how investor interest in Orlando continues to be strong and industrial lease rates are rising fast — thanks, in part, to the “Amazon effect,” i.e., warehouse demand driven by Amazon.com Inc.’s need for same-day shipping.

“We just went to contract on 7 acres in front of the Meritage Homes development in southeast Winter Park. We will do a 90,000-square-foot development there.” – Miguel de Arcos, managing director, Sperry Van Ness Florida

“We sold two properties at about $53 million, one to O’Connor Capital Partners to build Vineland Pointe. That is a pretty good indicator that retail is not as dead as some pundits would suggest.” – Daryl Carter, president, Maury L. Carter & Associates Inc.

“We closed the $121 million sale for The Crosslands on behalf of the seller, O’Connor Capital Partners, [in partnership with Tupperware Brands Corp.]. It was the first ground-up retail deal post-recession. We had a lot of foreign capital. When you see a larger trade in our region, people want to see bigger deal sizes.” – Brad Peterson, senior managing director/co-head, Holliday Fenoglio Fowler LP

“An industrial lease at Bent Oak Industrial Park on Taft Vineland Road — a Chinese manufacturer of tires. Orlando still has it, and these guys needed space in a timely manner. There weren’t many choices of that type of finished space. The kids can have Christmas again.” – Bill Bywater, president, The Bywater Co.

“Our biggest deal is the other Amazon fulfillment center in Florida — the 1 million-square-foot build-to-suit in Miami.” – Paul Ellis, CEO, Foundry Commercial LLC

“The Mercury 3100 apartment complex near UCF on Alafaya Trail, which sold for $51 million at an unprecedented cap rate. There is tremendous outside investor demand. About 65 percent of the deals that happened come from outside capital. That is a significant impact.” – Justin West, Orlando regional manager, Marcus & Millichap Real Estate Investment Services

“We hope to finish construction in December on Maitland City Centre. I see mixed-use — office, hotel, multifamily along with retail and anchor restaurants — as the future for traditional retail and development parcels.” – Brian Grandstaff, principal, Millenia Partners

“A 258-unit apartment deal just south of downtown. All the macro reasons for someone wanting to invest in downtown were at play: limited supply, absorption, job growth, and it’s a complete reposition for the asset. It’s good news about Orlando that makes them happy to come here.” – Joe LaFleur, multifamily investment adviser, 100Units.com

“One South Orange. It was a tech company [Orlando-based Launch That LLC] which wanted space downtown, so they bought a building and are using up the majority of the space. For a building without a parking garage, it was something special. It just speaks to the technology going into downtown Orlando.” – Patrick Mahoney, president/CEO, NAI Realvest

“Restaurants and bars have grown enormously in popularity. It’s the first time in our U.S. consumer market that going out to eat exceeded grocery-store sales.” – Brian Grandstaff, principal, Millenia Partners

“It’s good in Central Florida for folks in the land business. Pricing is at pre-recession levels. That may be part of the problem – sellers are noticing the transactions. People are proud of their land again. It’s pretty good — for now.” – Daryl Carter, president of Maury L. Carter & Associates Inc.

“We are seeing a lot of resumes come in from out-of-state. That speaks highly of Orlando that folks from Texas are saying, ‘It’s somewhere I consider.’ “ – Brad Peterson, senior managing director co-head, Holliday Fenoglio Fowler LP

“Our land pricing has gotten to a point where the traditional numbers — $150,000 per acre — are old news. The Amazon site was raw when it sold for $206,000 per acre, which was even more of a head-scratcher. We’re no longer viewed as a second-tier city.” – Bo Bradford, co-president and principal of Lee & Associates Central Florida

“When I-4 Ultimate kicked off several years ago, we thought there would be winners and losers. But we’ve seen Maitland Center go from almost 30 percent to single-digit vacancy. Maitland has been as good as it is in the worst of the construction. There is no migration, no true winners and losers, as a result of the project that I’ve seen.” – John Gilbert, managing director, JLL

“While the fundamentals are phenomenal, we are due for a correction. Clients seem to think we can time it perfectly. We are going to have a tremendous amount of development, but I have no idea where 2019 will be. I’m keeping my eye on tax reform. We all see these large tracts of land going to developers, but will they build?” – Miguel de Arcos, managing director, SVN Florida

“We thought people in Maitland would leave when I-4 Ultimate started, but people see the future of Maitland Center. Buildings have been refreshed. You have great institutional owners.” – Yvonne Baker, regional managing parter, Franklin Street

“I was surprised at how many cars were at the Wawa on the corner of West Colonial Drive and Orange Blossom Trail. The change in that whole neighborhood will dramatically impact downtown. It’s pretty exciting what’s happening at UCF Downtown. That will be a tremendous gain.” – Steve Garrity, Orlando vice president, Highwoods Properties Inc.